We Planned For the Future, But…

In The LOG we always like good Redwood Society stories – about people so touched by God at Mount Hermon that they’ve chosen to extend their legacy here with an estate gift. It is humbling to discover how some bequests arrive at an “appointed” time and in the exact amount needed for a crucial ministry opportunity. God delights in making this happen.

My own journey with my will and estate offers a word of warning. My husband, Mark, and I created a simple will when our first daughter was born. (Young parents, be sure you do that! Select a guardian yourself, not a court-assigned judge.) We also purchased ‘income replacement’ life insurance policies, with face values of ten times our salaries. By investing the proceeds at current interest rates the survivor could replace the income of the one who’d died. We were advised that would sufficiently sustain our lifestyle.

Then as many young couples do, we filed it, and never thought about it again … until. Twelve years later Mark was diagnosed with acute leukemia that took his life after a fierce nine-month battle. When serious illness is diagnosed, it is too late to revise your plan; you have to live – and sometimes die – with it.

Mark and I were both sobered to realize that, now as a ministry leader, his income had more than doubled in those twelve years. Also, we’d underestimated our income when we purchased our life insurance, as more than a third of our compensation was in tax-free housing, utilities and perks. Our premiums were low, but so would be the proceeds.

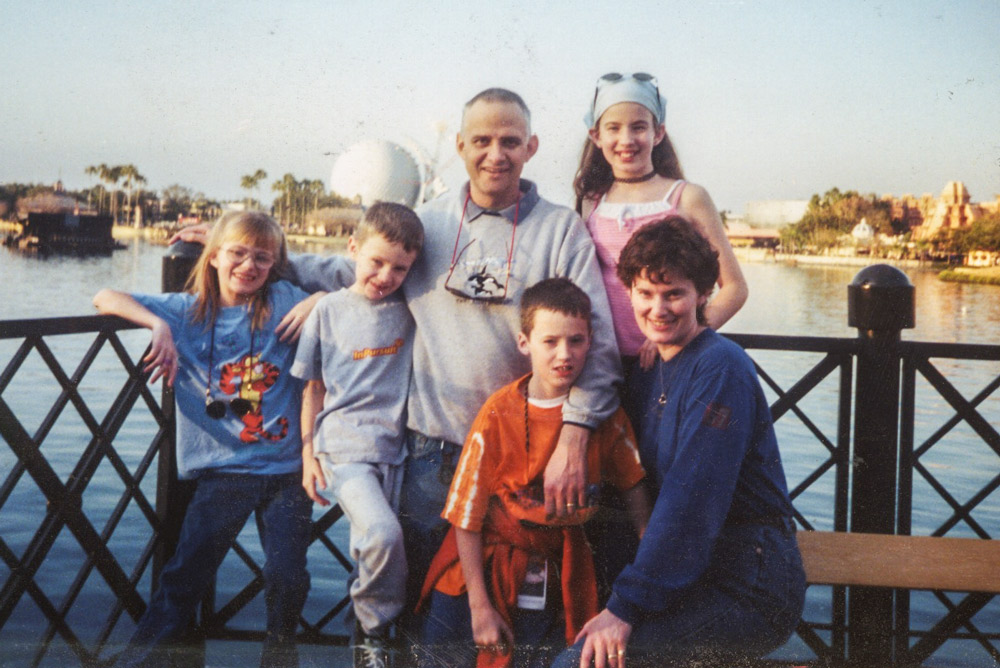

Plus, our family had grown! We now had four children, ages 6, 8, 10 and 12, one with autism, one with epilepsy. I worked part-time to help with speech therapy and medical expenses, and was consumed with being a mom.

There was nothing we could change, so we focused on fighting the cancer. It weighed heavily on Mark that I would immediately need to work full-time, since our meager life insurance proceeds would not begin to cover his income portion.

And that’s what I did. Within two weeks of Mark’s home-going I was working full-time so we could keep our medical benefits, and I cut our budget to fit within my salary alone. God has faithfully enabled me to provide for my kids, and the insurance was enough for a down payment on a house. In that way, Mark was able to provide that first home for us, for which I have been extremely grateful.

Even with few assets, our will still had a charitable clause: if our entire family suffered a catastrophic event, our estate would pass a substantial portion to our ministry as secondary beneficiaries of our life insurance policies. That would have represented a significant gift, marking our legacy there for generations to come.

Though we had an ‘estate plan’ – a will and life insurance – we did not review it annually as our family grew and needs changed. If you are without an estate plan that covers current needs, please address that today. Many free online tools can help you prepare a simple plan. Then revisit it annually! And don’t forget to include Mount Hermon in your will or as a beneficiary to an insurance policy, HSA or retirement plan, leaving a legacy for those who will follow you here in the redwoods.